what is a provisional tax code

Use our simple calculator to work out how big your tax refund will be when you submit your. This income could come from freelance work a.

Corporate Income Tax And Provisional Tax Obligations For Small Businesses Youtube

Amounts that you must pay under the provisional tax rules Amounts you choose to pay as voluntary payments to mitigate interest.

. Incorrect use of tax code or rate for PAYE interest or dividends. These can be due to. Change the provisional tax basis of a.

It is a method of paying the income tax liability in advance to ensure that the taxpayer does not have a large tax debt on assessment. In the Tax Form field select GST and Provisional Tax GST103. What is provisional tax.

Tax codes help your employer or payer work out how much tax to deduct from your pay benefit or pension. An example of this are individuals who earn income from other sources during any year of. A natural person who derives income other than remuneration or an.

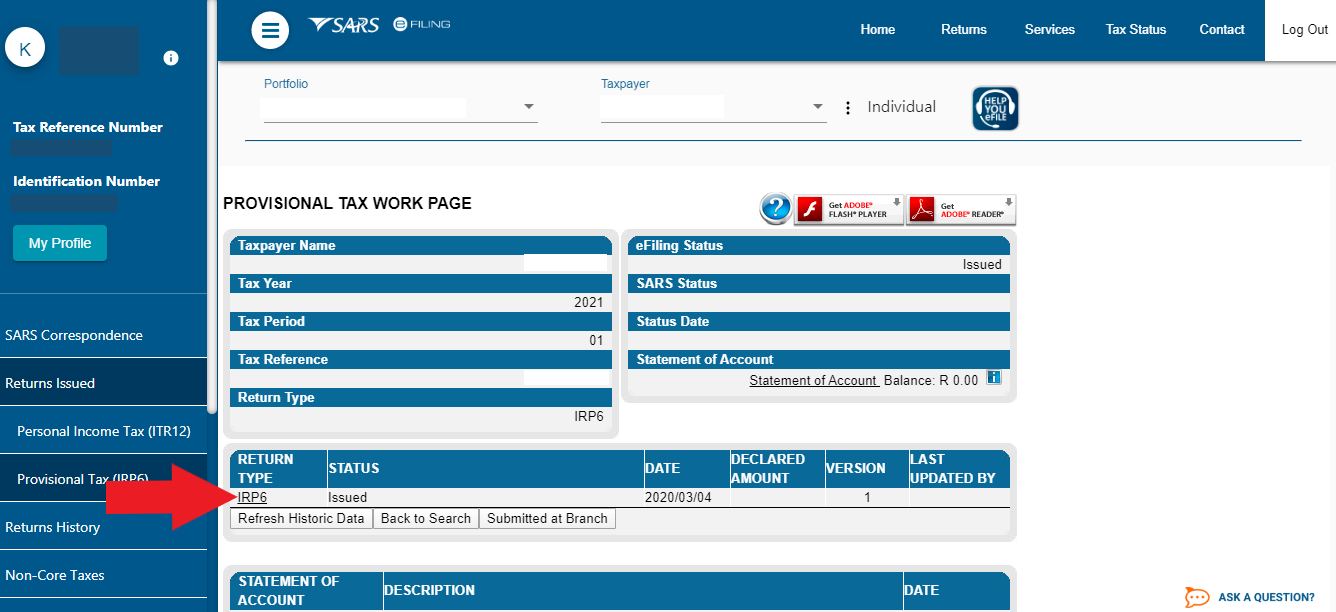

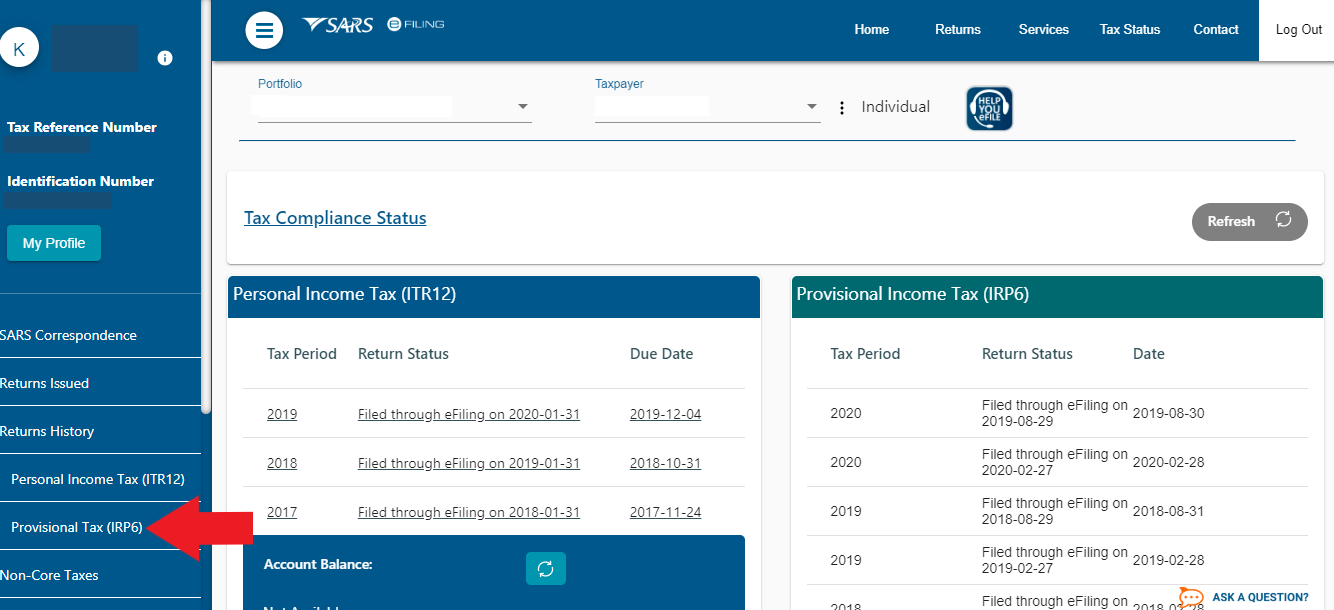

Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension. Who is provisional tax for. Provisional tax also called an IRP6 is for anyone who receives income other than a fixed salary.

The first provisional tax return must be submitted within. Provisional tax options There are 4 options available for working out your provisional tax. Hpssc Post Code 846 List Of Roll Nos Post Of Junior Engineer Supervisory Trainee Mechanical In 2021 Coding Office Assistant Post What Is Provisional Tax How And When Do.

Provisional tax payments can be made up of. Any person who receives an income other than a salary is a provisional taxpayer. A provisional taxpayer is.

A person who receives or to whom accrues other than a salary is a provisional taxpayer. Total tax paid first plus second provisional tax payments R 379 811 Use our handy income tax calculator to work out your tax obligation Calculation of penalty R 412 611. There are some situations where you may need to pay provisional tax on your reportable income.

Provisional tax is paid by people who earn income other than a salary traditional remuneration paid by an employer. If you earn non-salary income for example rental. You need to work out your tax code for each source of income you receive.

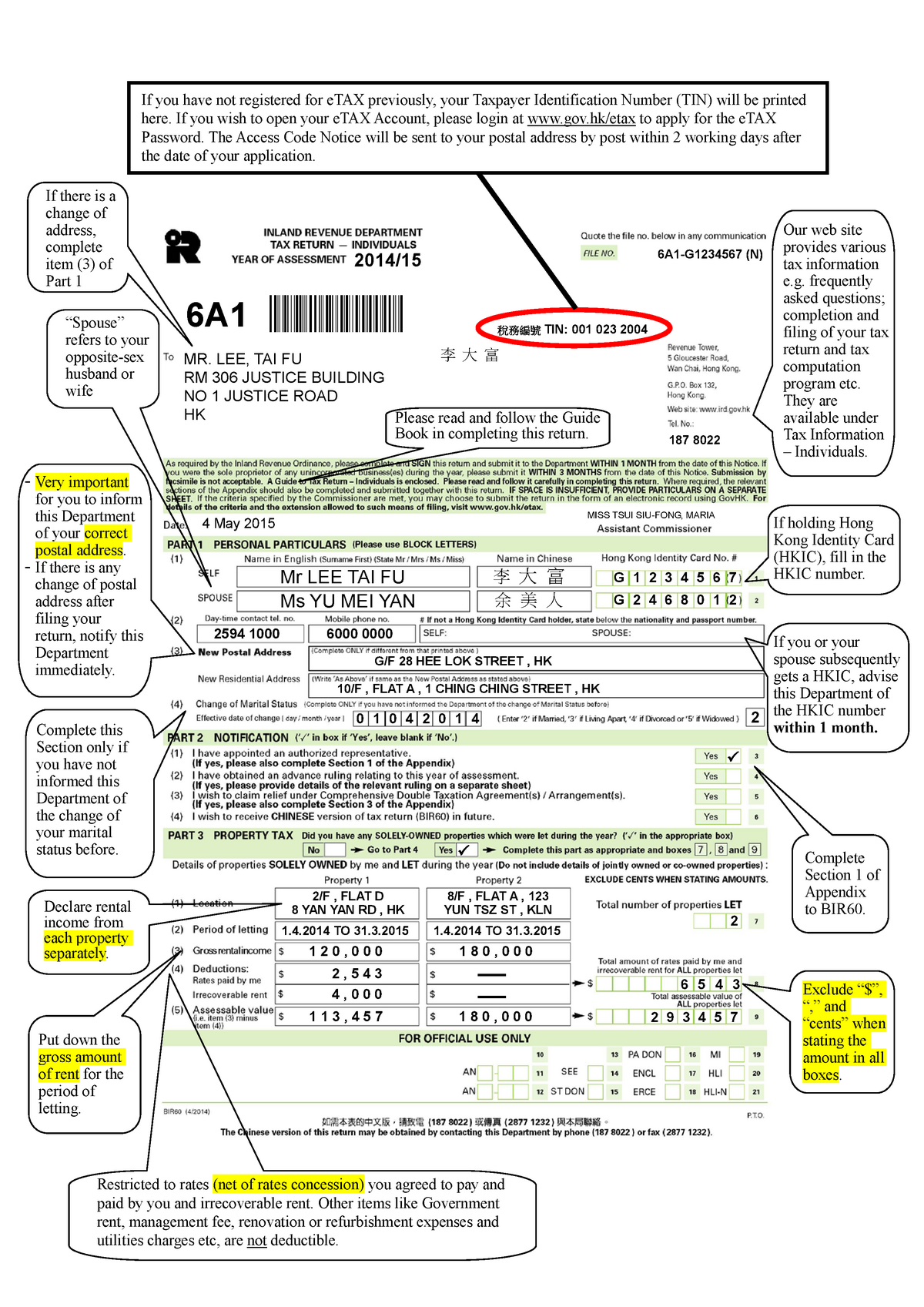

V The provisional tax payments together with. According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the previous. Provisional tax is paid by individuals who earn income other than a salary traditional remuneration paid by an employer.

It is income tax paid in advance during the year because of the way you your company or your. Use the check your Income Tax online service within your Personal Tax Account to find your tax code for the current year. HM Revenue and Customs HMRC will tell them which code.

Provisional tax allows the tax. Provisional tax is not a separate tax. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year.

Provisional tax is not a separate tax. In the Calculation field select your provisional tax calculation method.

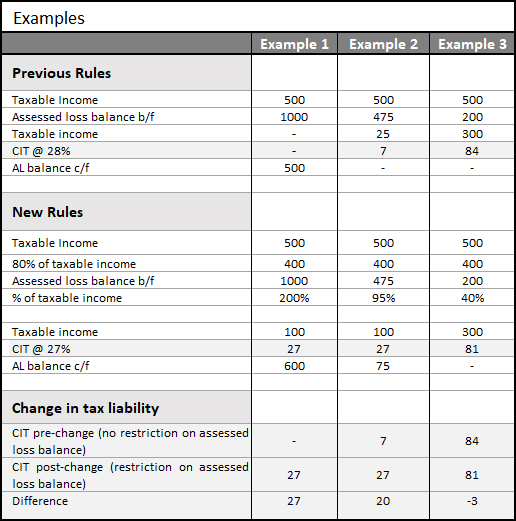

Companies How Will The Reduced Tax Rate And Assessed Loss Rules Affect You Bvsa Ltd More Than Just Numbers

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

Bir60 Sample Peter Chen If You Have Not Registered For Etax Previously Your Taxpayer Studocu

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

What Account Do I Enter Income Tax Payments Under

What To Do When Your Income Tax Return Itr12 Is Rejected By Sars On Efiling Due To A Directive Youtube

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

What Account Do I Enter Income Tax Payments Under

Getting Your Tax Code Erasmus Blog Milan Italy

Corporate Income Tax And Provisional Tax Obligations For Small Businesses Youtube

Italian Tax Code Codice Fiscale Studio Legale Metta

Part 3 Income Tax And Provisional Tax

What Is Provisional Tax How And When Do I Pay It Taxtim Sa

How To Get The Italian Tax Code Yesmilano

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal