tax on venmo over 600

If you receive over 600 in income through these sources you will receive a Form 1099-K and a duplicate form. Venmo charges the following fees for selling or buying cryptocurrencies.

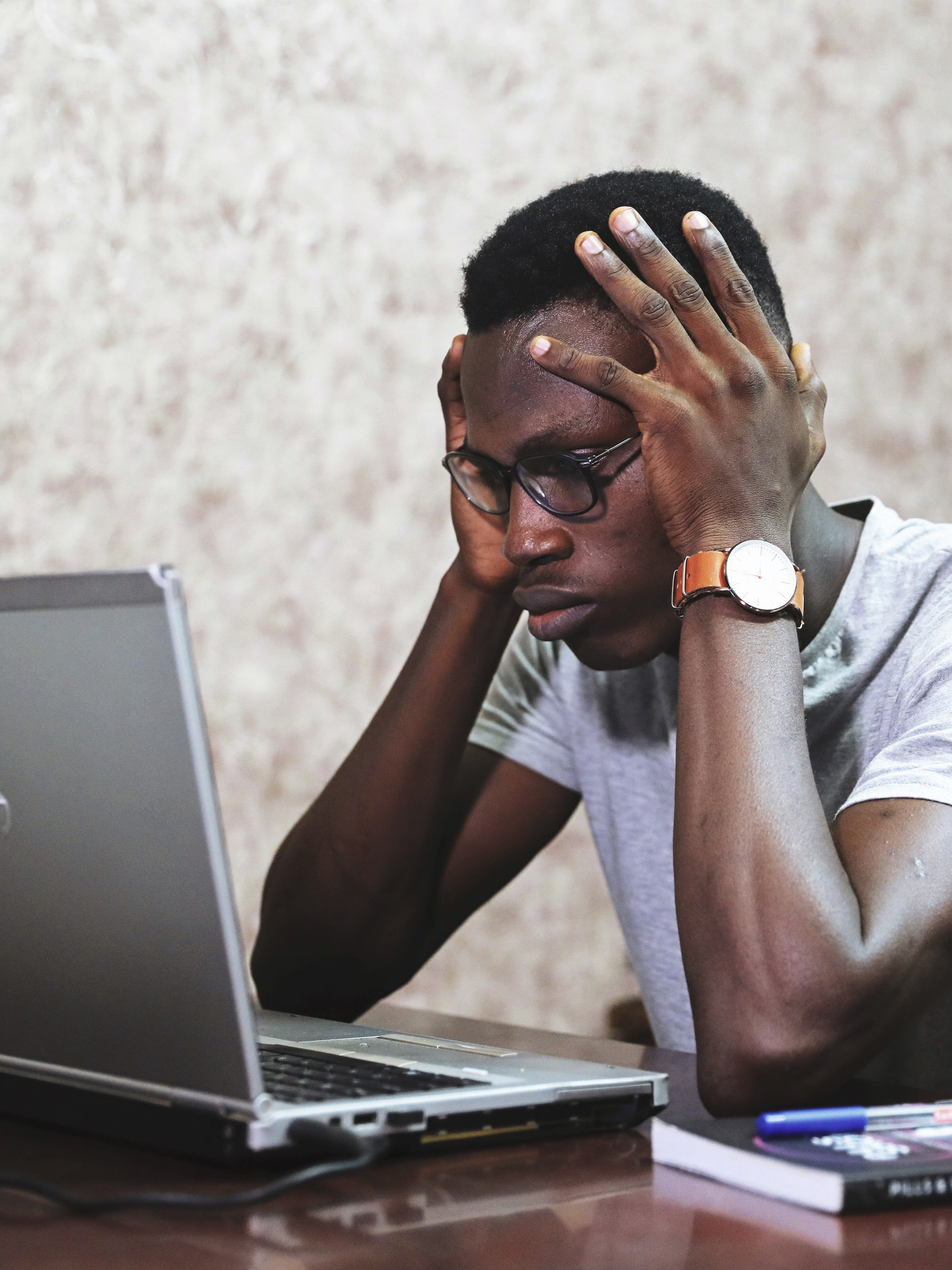

Have Y All Seen This The Irs Is Coming For Small Businesses Making 600 A Year Through Paypal And Venmo I M So Stressed And Upset At This Depop Is Crucial Additional Income For

If your Venmo or CashApp transactions exceed 600 and qualify as taxable income you will likely be sent a 1099-K by the IRS to fill out.

. A new IRS rule passed by Democrats will require users of PayPal Venmo and other third-party payment services to report transactions. The new tax reporting requirement will impact your 2022 tax return filed in 2023. This does not mean that you will.

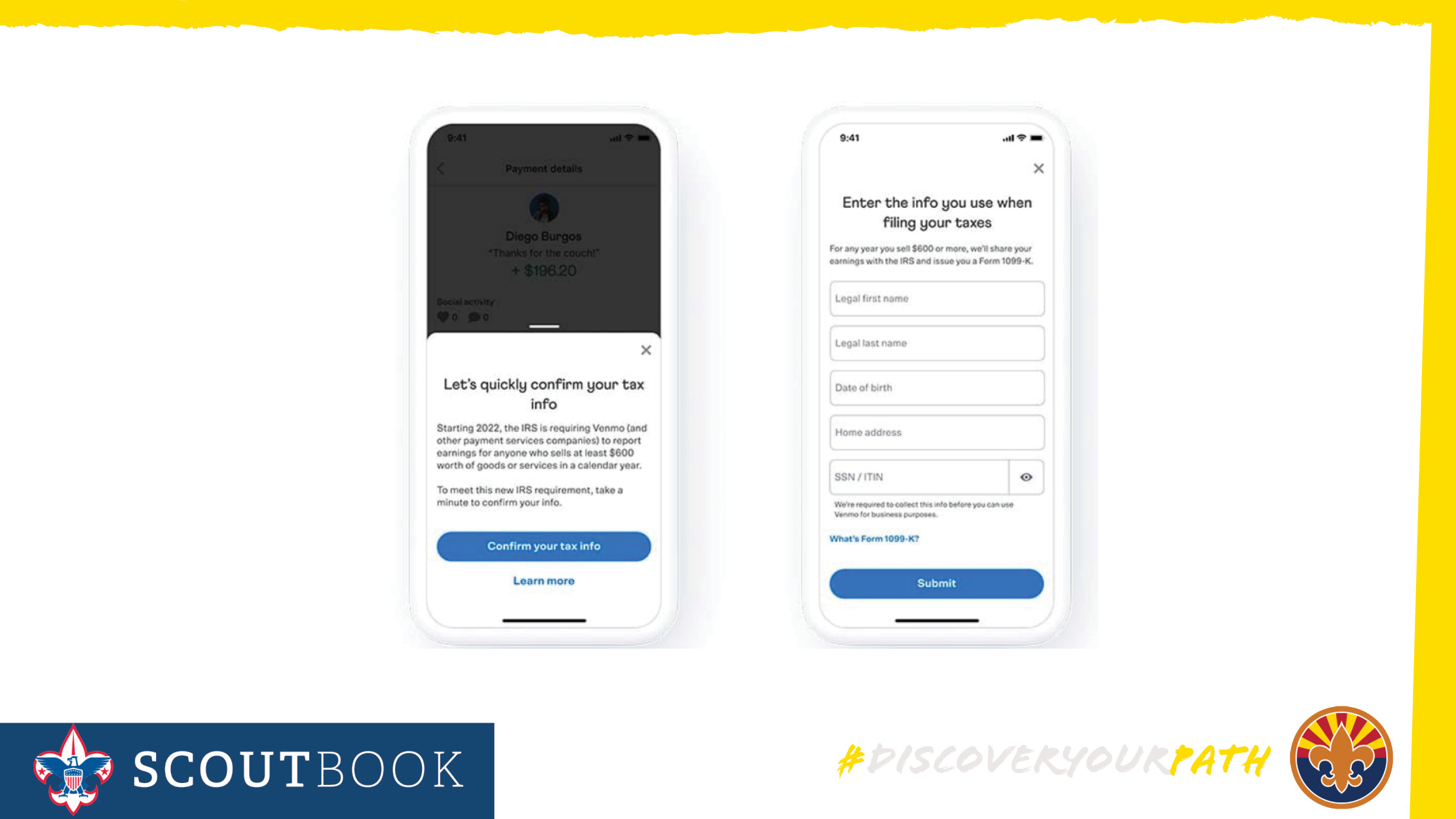

February 7 2022 436pm. 1 the IRS said if a person accrues more than 600 annually in commercial payments on an app like Venmo then. Rather small business owners independent.

If your Venmo or CashApp transactions exceed 600 and qualify as taxable income you will likely be sent a 1099-K by the IRS to fill out. If you receive 600 or more payments for. Per last years American Rescue Plan Act so-called peer-to-peer payment platforms like Venmo or Paypal will now have to report any persons cumulative business.

A 49-cent fee for purchases and sales of 1 up to 499. Theres a little bit of confusion over this Venmo rule says Steven Rosenthal senior fellow at the Urban-Brookings Tax Policy Center at the Urban Institute. This new rule does not apply to payments received for personal expenses.

1 the Internal Revenue Service IRS requires reporting of payment transactions via apps such as Venmo PayPal Stripe and Square for goods and services sold which meet or. WJBF A change from the IRS may complicate next tax season for small business owners who use apps. Business Venmo transactions over 600 taxed.

As of Jan. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. 1 the IRS said if a person accrues more than 600 annually in commercial payments on an app like Venmo then Venmo must file and furnish a Form 1099.

This will change the way that you file your taxes next year. 1 That means its super easy to pitch in or get paid back for all sorts of things like. 1 the Internal Revenue Service IRS requires reporting of payment transactions via apps such as Venmo PayPal Stripe and Square for goods and services sold.

Fact Or Fiction The Irs Will Track Payments Over 600 On Paypal And Venmo In 2022 List23 Latest U S World News This new rule wont affect 2021 federal tax. Previously these mobile payment apps only had to tell the tax authorities when a person had over 200 commercial transactions per year that exceeded 20000 in total value. A 99-cent fee for purchases and sales of 5 up.

Any income you make over 600 is now being reported to the Internal Revenue Service by payment apps including eBay Venmo and Airbnb. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. Side hustlers beware.

Zelle is a great way to send money to friends and family even if they bank somewhere different than you do. Starting this month users selling goods and services through such popular sites as Venmo Etsy and Airbnb will begin receiving tax forms if they take a payment of more than 600. If you make 600 or.

Anyone who receives at least. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling. No Venmo isnt going to tax you if you receive more than 600.

The new rules simply make sure that this income is reported. This applies to those who have a business and are set up to accept payment cards or payments from a third-party settlement organization then you will receive a Form 1099-K. Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like.

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

Is The Irs Taxing Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know

New Law Impacting Peer To Peer Payment App Users

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

The New 600 Cash App Tax Law Explained Answering Your Questions Starting January 2021 Users Of Their Prefered Third Payment Network Will Begin Receiving Tax Forms 1099 K If They Receive

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas

Paypal Venmo Update For Bsa Units Grand Canyon Council Boy Scouts Of America

Paypal And Venmo Taxes What You Need To Know About P2p Platforms Turbotax Tax Tips Videos

The American Rescue Plan Act Venmo Zelle 600 Now Taxed Obvious Magazine

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

Venmo And Paypal Will Now Share Your Transactions With The Irs If You Make More Than 600 A Year On The Platforms The Washington Post

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Us Stimulus Did Not Include New Tax On App Payments Fact Check

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Tax Changes Coming For Cash App Transactions

Business Venmo Transactions Over 600 Taxed Wjbf

Tax Clean Up Venmo Paypal And Zelle Must Report 600 Facebook

Venmo On Twitter Got Questions About Venmo Amp Taxes Let S Break Down Which Payments Are And Aren T Affected By The 2022 Tax Changes For More Info Head To Https T Co Pwh2p15gl2 Https T Co Behbpcnsxj Twitter